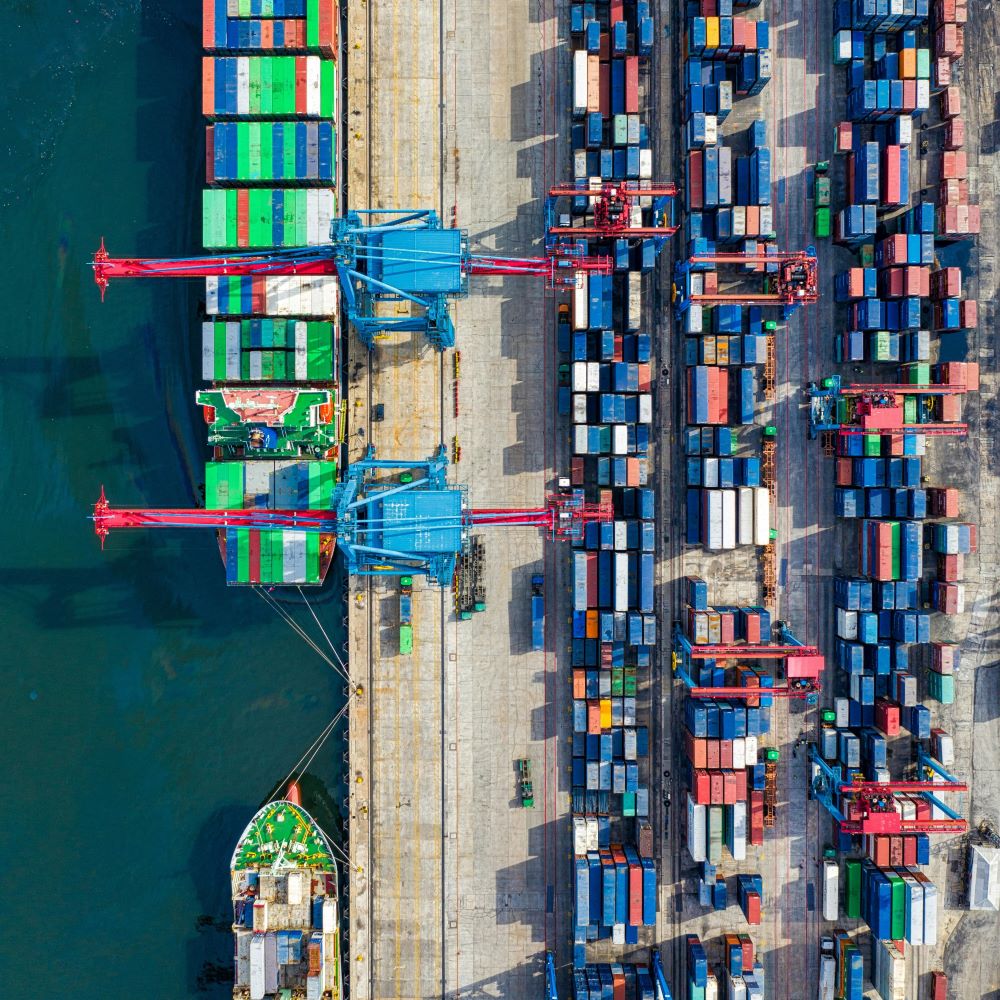

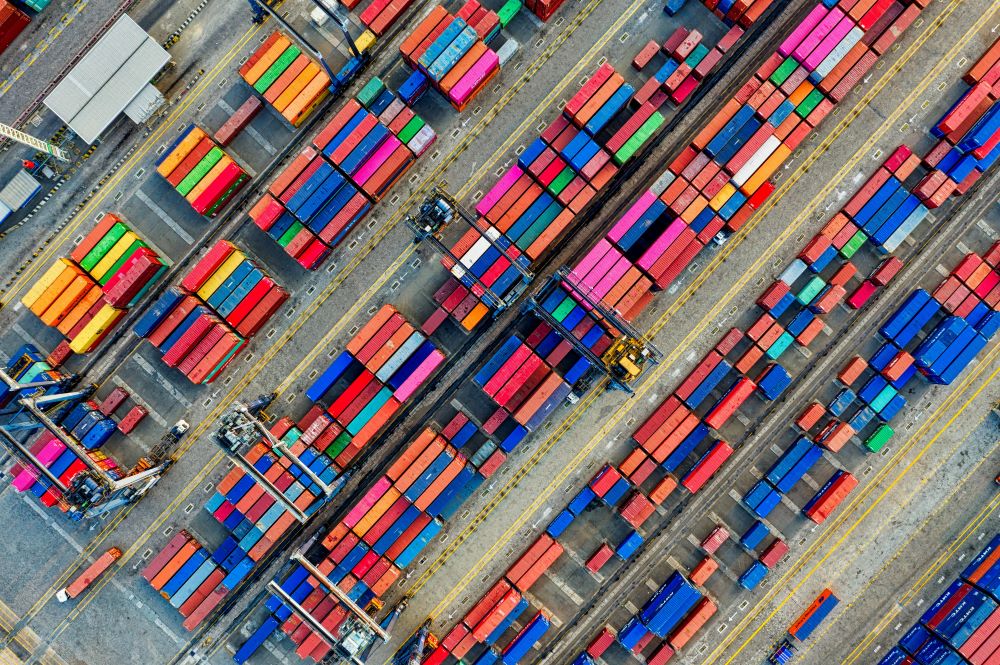

The African Growth and Opportunity Act (AGOA), a pivotal trade agreement between the United States and several sub-Saharan African nations, expired on 30 September 2025. Since its enactment in 2000, AGOA had been instrumental in strengthening United States/Africa economic ties by offering duty free access to the U.S. market for over 1,800 products from eligible African countries (in addition to more than 5,000 products previously listed under the U.S. Generalised System of Preferences, a separate and long-standing U.S. trade program that itself expired at the end of 2020).

The expiry of AGOA raises questions about the future of trade between the U.S. and East Africa, particularly for key regional players like Kenya and Tanzania. Unless AGOA is reinstated or replaced with an analogous arrangement soon, the effects of this change will likely be felt across various sectors, necessitating a strategic recalibration for these countries and their respective industries.