Subscribe to our Newsletter to receive the latest updates on our content. By tapping the “Subscribe” button you will be redirected to subscription page. Subscription is free.

Tax dispute avoidance and resolution procedures are essential to the effective and efficient functioning of all tax administrations as well as ensuring certainty and predictability for businesses. Both these elements are critical for building an international tax system that supports economic growth and a resilient global economy.

Since the emergence of the global financial crisis, reforms to the international tax system have been high on the political agenda as governments are now working more closely to deal with perceived weaknesses in the international tax rules that create opportunities for Base Erosion and Profit Shifting (BEPS). The bold measures proposed by the Organisation for Economic Co operation and Development (OECD) G20 Inclusive Framework on BEPS are geared towards restoring confidence in the international tax system and ensure that profits are taxed where economic activities take place as well as creating value. However, countries also agree that the introduction of measures to address BEPS should not lead to unnecessary uncertainty for compliant taxpayers and lead to unintended double taxation.

As African governments pick up on the pace of implementing the new BEPS measures and building greater audit capacity multinational entities are increasingly finding themselves exposed to double taxation mainly due to transfer pricing audit adjustments. Double Tax Treaty Agreements (DTTAs) are a critical tool not only for preventing cross border tax avoidance and evasion but also to provide an effective and efficient means to prevent double taxation.

Most double tax treaties adopt Article 25 of the UN and OECD Model Tax Convention which provides an additional dispute resolution mechanism in addition to domestic remedies. Where a person considers that the actions of one or both of the Contracting States result or will result for them in taxation, not in accordance with the provisions of this Convention, they may, irrespective of the remedies be provided by the domestic law of those States, present their case to the competent authority of either Contracting State. The Article, therefore, provides competent authorities of two governments with a mechanism to resolve differences or difficulties regarding the application and interpretation of double tax treaties on a mutually agreed basis.

This alert highlights the processes of initiating and process of Mutual Agreement Procedures (MAP) and how these can be beneficial to a taxpayer seeking to resolve issues of double taxation.

MAP is best described as a government-to-government process for cross border tax dispute resolution where competent authorities endeavour to amicably solve disputes falling within the scope of DTTAs. Competent authorities are obliged to use their best efforts to reach a settlement, and should be consistent and reciprocal in the positions they take and not change positions on an issue depending on which side produces more revenue.

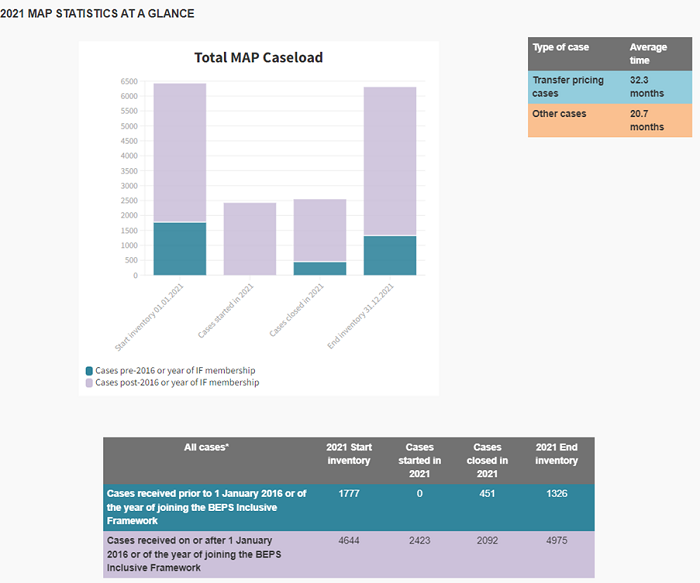

With increased instances of cross border transfer pricing adjustments and disputes arising under DTTAs, it is worth exploring the MAP process and understanding its unique characteristics and the role it plays in resolving international tax disputes. According to MAP data for OECD countries and some partner economies available on the OECD website the global number of MAP disputes has been rising rapidly since 2015 as indicated by the diagram below:

Source: 2021 Mutual Agreement Procedure Statistics – OECD

However, according to the Commentary to the UN Model Tax Convention, tax administrations in Africa have not considered MAP as a priority given that most disputes are resolved internally. The ultimate loser from tax disputes not being resolved is the multinational business exposed to double taxation. Businesses faced with such a predicament should seriously consider the opportunities availed by the MAP process where a DTTA is in place between the two jurisdictions involved in a given transaction.

The report on BEPS Action 14 (Making Dispute Resolution Mechanisms More Effective) contains a commitment by jurisdictions to implement a minimum standard to ensure that they resolve treaty-related disputes in a timely, effective and efficient manner which is within two years.

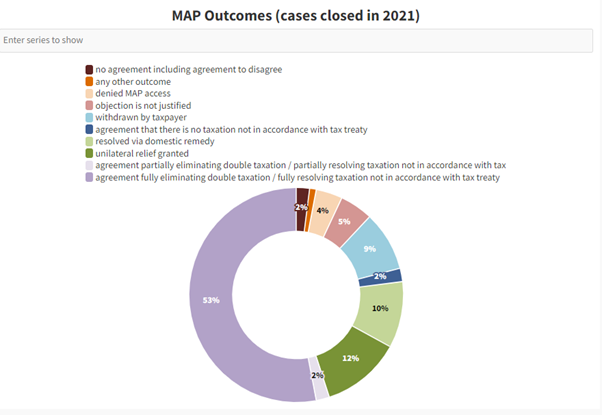

As a rule, competent authorities are not compelled to arrive at an agreement. As a matter of fact, global statistics show that not all disputes referred to MAP result in the settlement of double taxation cases as demonstrated by the diagram below. The OECD Model Convention contains a new clause 5 which proposes that countries adopt binding arbitration at the request of the taxpayer where no agreement is reached within two years. It is noteworthy that, so far only the Kenya and Netherlands DTTA (not in force) contains the binding arbitration clause.

Source: (2021 Mutual Agreement Procedure Statistics – OECD)

Overview of the MAP Process

In the event a taxpayer is of the opinion that the activities of one or both countries’ tax administration can result in taxation being contrary with the provisions of a tax convention, the taxpayer may request for competent authority assistance under the MAP provision contained in the relevant DTTA.

In instances of double taxation, the agreement arrived at between the competent authorities sets out the extent to which each jurisdiction will provide relief and how the relief will be provided. Details such as method of relief (e.g., such as adjustment to income, credit exemption etc.) is followed by an exchange of letters between the competent authorities which formalises the agreement. The taxpayer is then notified in writing concerning the decision and is provided with an explanation of the outcome.

Competent authority agreements or resolutions are not considered precedents for either the taxpayer or the tax administrators concerning adjustments or issues involving subsequent years or for competent authority discussions on similar issues for other taxpayers. Practical and pragmatic solutions to contentious MAP cases are regularly the result of compromise and concessions made by the parties involved meaning a holistic approach is routinely used.

Position Papers

To achieve timely resolution and to facilitate significant deliberations competent authorities usually prepare and transmit a position paper as a matter of priority. The position paper enables the other competent authority to comprehend the dispute and establish the ideal course of action to alleviate double taxation or determine the issue altogether.

The country that has taken an action that led to the taxation which is purported to be conflicting to the provision(s) of a DTTA customarily supplies a position paper (notwithstanding whether that is the competent authority to which the taxpayer has made its application).

Debriefing the Taxpayer

Since competent authority proceedings are a government-to-government process and taxpayers do not have a specific right to attend or observe discussions, the competent authorities recognise that the taxpayer is a stakeholder and client in the MAP process. As such, it is appropriate to debrief the taxpayer after each substantial MAP and at the conclusion of a file – the debriefing should give the taxpayer some general sense of direction of the case which provides some form of transparency regarding the process.

The competent authorities are required to communicate the terms of the resolution to the taxpayer. If the terms and conditions of the resolution are not satisfactory to the taxpayer, they may be entitled to withdraw from the MAP process and pursue other domestic redress mechanisms still available.

If the terms of the resolutions are satisfactory, the taxpayer accepts the MAP results in writing and agrees to withdraw its domestic objections (if filed) or to refrain from seeking any further recourse on the same issue.

Once letters have been exchanged, and where the taxpayer has accepted the resolution, a competent authority should give it effect in its own jurisdiction.

MAP and Domestic Law

In most cases, the taxpayer has the option of choosing to deal with a case either via MAP or domestic route, but not both simultaneously in order to avoid duplication of effort. However, the taxpayer has the opportunity and at any time during the domestic process to initiate MAP.

For purposes of making a MAP request, it is only sufficient if the taxpayer establishes that the challenged taxation is probable – an actual adjustment is not necessary, and taxpayers may contact the competent authorities at any time irrespective of whether a domestic route has been commenced. Once the competent authorities have been notified of a case, they are obliged to discuss the merits of the dispute or issue at hand.

Conclusion

MAP can be advantageous to a taxpayer since it affords some advantages to a taxpayer as indicated below:

- MAP offers a peer review which has a moderating effect due to the fact that decisions touching on tax disputes of an international nature are reviewed by authorities of a similar stature;

- it offers an additional opportunity to a taxpayer to settle an international tax dispute outside the domestic law;

- it is in essence an amicable manner to resolving an international tax dispute with a focus on eliminating double taxation in the event of any transfer pricing adjustments; and

- it can create certainty in the minds of the stakeholders involved.

Should you require more information or have any questions regarding the contents of this legal alert, please do not hesitate to contact James Karanja.

_____________

Contributors

1. Abdullahi Ali – Associate

2. Jacob Odanga – Trainee Lawyer