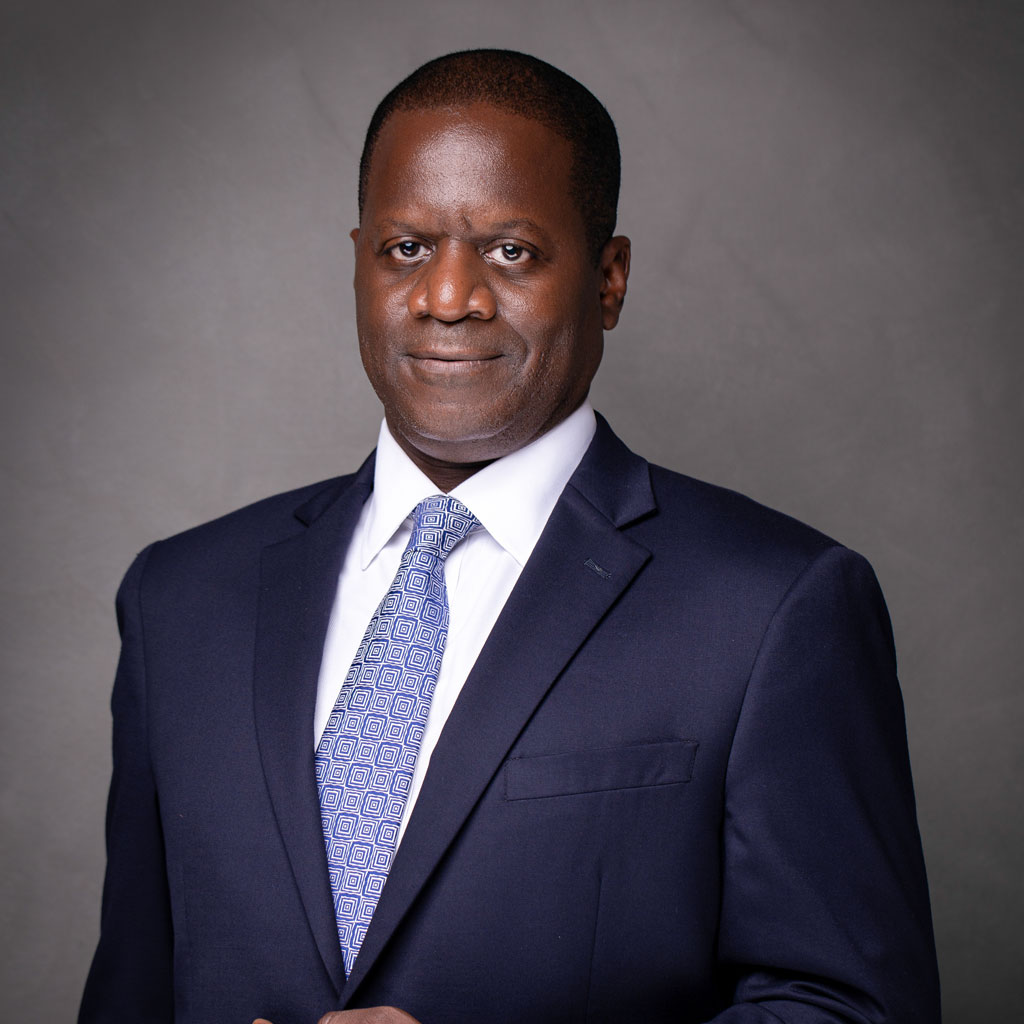

Timothy Masembe

Managing Partner | ALN Uganda | MMAKS Advocates

Physical Address:

4th Floor, Redstone House, Plot 7 Bandali Rise, Kampala, Uganda

Postal Address:

P.O Box: 7166, Kampala, Uganda

Telephone:

+256 414 259 920Email Address:

-

Background

Masembe is the managing partner of MMAKS Advocates and the head of the firm’s Litigation Department. His practice focuses mainly on commercial litigation and arbitration, as well as corporate and commercial law.

He is a Barrister-at-law and a Member of the Honourable Society of the Inner Temple, UK. He holds an LLB (Hons.) degree and was called to the Bar of England and Wales in 1992. In addition he holds a Diploma in Legal Practice of the Law Development Centre in Uganda.

Masembe is one of the leading litigators in Uganda, and has appeared in many ground breaking cases involving banks. He was recently granted a special license to appear in the courts of Tanzania. Timothy has also been consistently ranked as a Band 1 commercial lawyer by the Chambers Global. He has been an external lead counsel for the Bank of Uganda and has thus been at the centre of the reconstruction and improvement of Uganda’s entire banking sector.

In addition, Masembe has recently been appointed as a member of the Capital Markets Authority Board.

-

Professional Membership

- Advocate, High Court of Uganda

- Barrister-at-law, England & Wales

- Member, Honourable Society of Inner Temple, England

-

Professional Qualifications

- Postgraduate Diploma in Legal Practice, Law Development Centre (Uganda)

- LL.B (Hons.), University of London, England

-

Career Summary

2005 – Date: Partner, MMAKS Advocates

1993 – 2005: Advocate and Partner, Mugerwa & Masembe Advocates

-

Awards and Recognition

- Masembe is consistently ranked as a leading lawyer in his field by Chambers Global.

- Chambers Global, 2015 recognises Masembe’s strength in litigation and states that “he is a thorough researcher” and is “relentless in court”.

- Chambers Global 2014 recognises Masembe as one who “makes a great impression in court.”

- Chambers Global, 2011 recognises that Masembe ‘is good at identifying issues in complex matters and really knows his way around the court’.

-

Top Matters

- Acting for the Bank of Uganda in a suit involving fraudulent acquisition and conveyance of securities encumbered by the Plaintiffs to secure a debt facility of USD20 million

- Acting for Barclays Bank and ABSA to defend a suit seeking nullification of a structured agricultural finance facility worth USD29.4 million advanced by the defendants

- Acting successfully for Kenyan and Tanzanian company in connection with a complex arbitration dispute referred to the London Court of International Arbitration (LCIA) arising out of a consortium agreement

- Acting for Aggreko Uganda Limited (a thermal power distributor) contesting a VAT assessment levied it by the Uganda Revenue Authority of Ug. Shs. 145 billion equivalent to USD58 million. The matter was successfully defended by a Judgment of the 12th September 2012.

- Acting for Google Uganda Limited in a suit seeking a declaration to the effect that the exclusive supply of marketing and sales support services to Google Ireland Limited was an exported service and is as such zero-rated.

- Acting for Bank of Uganda and Standard Chartered Bank to recover USD34 million from guarantors of a company indebted to Standard Chartered under various facilities assigned to Bank of Uganda.

6 / 23