The Nigeria Tax Act, 2025 (NTA), the Nigeria Tax Administration Act, 2025 (NTAA), the Nigeria Revenue Service (Establishment) Act, 2025 (NRSA) and the Joint Revenue Board (Establishment) Act, 2025 (JRBA) (collectively referred to herein as the New Tax Acts) which were recently signed into law by the President of Nigeria have established a new tax regime for Nigeria and are set to become effective in 2026.

Insight type: Legal Alert

The East African Community Ushers in a New Competition and Mergers Regulatory Regime

The East African Community (EAC) Competition Authority (the EAC Authority) has, in a notice dated 1 July 2025, announced that it will begin receiving and approving notifications for mergers and acquisitions with cross-border effect within the EAC region from 1 November 2025. This marks a significant operational milestone in the regional competition landscape, and it is expected to have a significant impact on cross-border M&A in the region.

Tanzania Restriction on Non-Citizens from Certain Business Activities Under New Licensing Order

On 28 July 2025, the Government of Tanzania issued The Business Licensing (Prohibition of Business Activities for Non-Citizens) Order, 2025 (the Order), barring non-citizens from obtaining or renewing licences for 15 specified small-scale business activities, including retail trade, mobile money services, salon businesses, and small-scale mining.

New Employer Obligations Relating to Persons with Disabilities

The Persons with Disabilities Act, 2025 (the 2025 Act) came into force on 27 May 2025. The new statute repeals the earlier 2003 Persons with Disabilities Act (Cap. 133) and puts in place a more inclusive and enforceable framework. Among the most significant areas of reform is in the employment regime, where persons with disabilities have historically faced systemic barriers, discrimination and exclusion.

Beyond Bricks and Mortar: Rethinking Permanent Establishment in Kenya’s Digital Age

An emerging trend in recent tax disputes in Kenya suggests that the Kenya Revenue Authority (KRA) is adopting an increasingly expansive approach to Permanent Establishment (PE) and profit issues. In several ongoing appeals, KRA has sought to assert PE based on minimal or indirect local activity, and to apply the Profit Split Method (PSM) to allocate a portion of global profits to Kenya—often with limited regard for the actual scale or nature of the local contribution.

Accelerating Kenya’s e-Mobility Sector: Key Fiscal & Non-Fiscal Incentives Needed for Growth

The Electric Mobility sector is a rapidly growing part of Kenya’s automotive industry, encompassing different types of vehicles: cars, motorcycles, two and three-wheelers, buses, bicycles, batteries, accessories and charging infrastructure. The sector has experienced significant growth, with data showing that electric vehicle (EVs) registrations have more than doubled over the past two years. Additionally, several EV companies have set up operations in Kenya. This growth is attributable to the efforts of key stakeholders in the sector, including the Government.

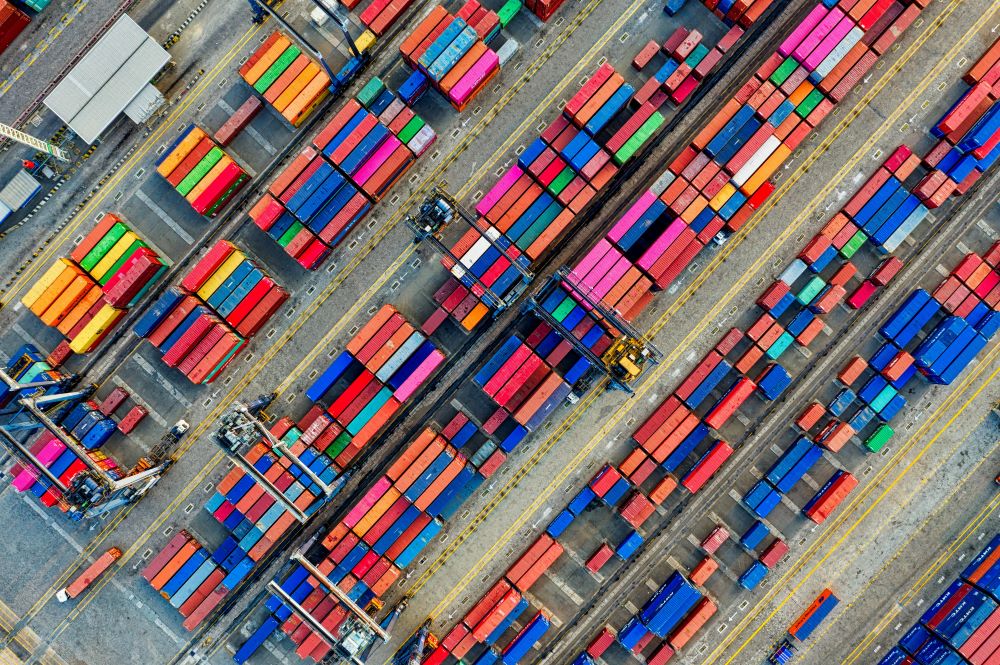

China and Kenya Deepen Relations Amid Global Instability: Strategic Implications for Africa and Beyond

China and Kenya entered a trade pact following a Ministerial Meeting of Coordinators for the Implementation of Follow-up Actions from the Forum on China-Africa Cooperation that took place in Changsha, Hunan Province, China on 11 June 2025. In a joint declaration between the Chinese and 53 African Foreign Ministers titled ‘China-Africa Changsha Declaration on Upholding Solidarity and Cooperation of the Global South’, China offered duty-free access for African products entering Chinese markets.

Analysis of the Tax Changes Introduced by the Finance Act, 2025

The Finance Act, 2025 (the Finance Act or the Act) was enacted by Parliament, assented to law by the President and subsequently published in the Special Gazette on 30 June 2025. The Act, which came into force on 1 July 2025, has introduced amendments to various statutes, including the Income Tax Act, Value Added Tax Act, Tax Administration Act, and other sector-specific laws.

Supreme Court Affirms Inheritance Rights of Children Born Out of Wedlock

In a recent judgment, the Supreme Court of Kenya affirmed that children born out of wedlock are entitled to inherit from their deceased Muslim father’s intestate estate.

This landmark case involved competing inheritance claims between children born both within and outside of marriage, raising questions about the interplay between Islamic inheritance law and the constitutional principle of equality.

Extension and Renewal of Leasehold Titles in Nairobi City County

The National Land Commission (NLC) issued a notice on 22 June 2025 calling on all property owners in Nairobi City County holding leasehold titles that have either expired or have 5 years or less remaining, to apply for the extension or renewal of their leases. This notice is particularly relevant to both individuals and incorporated entities, including management companies and financial institutions holding securities over leasehold property.