Rwanda has made significant strides in data protection and privacy with the enactment of Law no. 058/2021 of 13 October 2021 Relating to the Protection of Personal Data and Privacy (Data Protection and Privacy Law), which came into force on the 15 October 2021.

Insight type: Legal Alert

The Supreme Court Rules, 2024: A Step in the Right Direction? [Part 1]

The Supreme Court Rules 2024 (the New Rules), though gazetted on 15 August 2024, came into effect on 1 August 2024. The New Rules come almost four (4) decades after the Supreme Court Rules 1985 (the Old Rules). Although the Old Rules were amended twice, in 1999 and 2014, the New Rules appear to have aligned the practice and procedure of the apex Court with the demands of modern-day Nigeria.

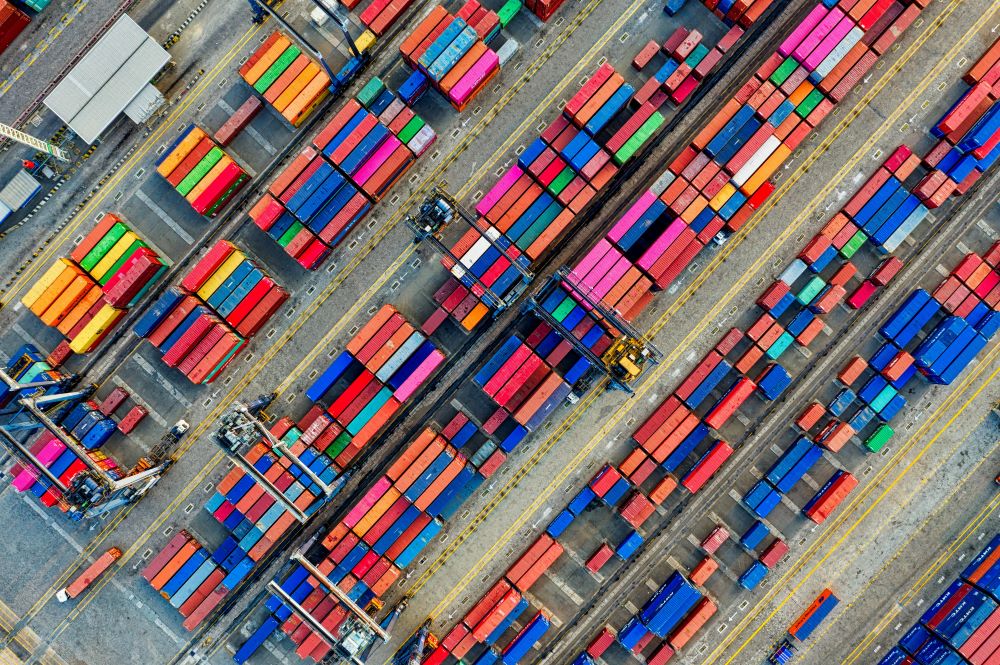

Kenya-United Arab Emirates Comprehensive Economic Partnership Agreement

On January 14 2025, President William Ruto of Kenya and His Highness Sheikh Mohamed bin Zayed Al Nahyan, President of the UAE, presided over the signing of the Kenya-UAE Comprehensive Economic Partnership Agreement (the CEPA). This landmark agreement aims to strengthen trade ties, attract investment, and foster economic cooperation between the two nations.

Digital Assets as “Securities” under Nigerian Law: Regulatory Evolution and the Way Forward

Globally, the rate of adoption of digital assets has been on a steady rise, and the growing interest and adoption of digital assets in Nigeria have attracted increased regulatory attention in recent times.

Mandatory Registration of Guardians appointed under a Will or by Deed

The Children (Guardianship) (Practice and Procedure) Rules, 2024 (the Rules) came into effect on October 2024. The Rules provide that a guardian can be appointed to look after a child during a parent’s lifetime, look after a child upon a parent’s death and/or manage a child’s estate and inheritance.

NUPRC Issues the Upstream Petroleum Decarbonisation Template

Pursuant to the Petroleum Industry Act 2021, the Nigerian Petroleum Regulatory Commission (NUPRC) has issued the Upstream Petroleum Decarbonisation Template (UPDT). The UDPT is a regulatory tool for promoting energy sustainability and environmental stewardship in Nigeria’s upstream operations. This is part of Nigeria’s commitment to net zero emissions by 2060 and in line with global energy transition plans. The UPDT will be implemented from 1 January 2025 as a mandatory component in applications for licences, permits, and approvals across upstream activities.

Conundrum of Early Termination of Fixed Term Commercial Leases: Implications for Landlords and Tenants

The Supreme Court recently issued a judgement in the case of Kwanza Estates Limited v Jomo Kenyatta University of Agriculture and Technology (Petition No. E001 of 2024) addressing early termination of fixed term commercial leases by tenants.

Analysis of the Tax Changes Introduced by the Tax Laws (Amendment) Act, 2024 and the Tax Procedures (Amendment) Act, 2024

The Tax Laws (Amendment) Act, 2024 (the TLA Act) and the Tax Procedures (Amendment) Act, 2024 (the TPA Act) (together referred to as the Acts) were assented into law by the President on 11 December 2024 and came into effect on 27 December 2024.

The Acts have reintroduced some proposals contained in the Finance Bill, 2024 (the Finance Bill) which was withdrawn in June 2024 following countrywide demonstrations against the imposition of additional tax measures. A copy of our analysis of the Finance Bill can be found here.

Imminent Changes to Nigeria’s Investments and Securities Law

Recently, the Nigerian Senate conducted the third reading of the Investments and Securities Bill 2024 (the ISB) following the recommendations of the Committee on Capital Market. This marks a significant milestone in the legislative process and brings the ISB closer to becoming law.

Overview of Mutual Agreement Procedures Guidelines Released by KRA

The Kenya Revenue Authority (KRA) recently published guidance on the Mutual Agreement Procedures (MAP) to help taxpayers address tax disputes under Kenya’s Double Tax Agreements (DTAs). These guidelines aim to align with the OECD’s BEPS Action 14 Minimum Standards, which promote efficient, timely, and effective resolution of tax disputes.

![The Supreme Court Rules, 2024: A Step in the Right Direction? [Part 1]](https://aln.africa/wp-content/uploads/2024/06/Lagos-WF.jpg)