East – Central Africa

Equity Bank’s USD 6 Billion ‘Marshall Plan’ for SMEs

Equity Bank, which is East Africa’s largest banking group and led by James Mwangi, is planning extensive assistance to boost the private sector in its six countries of operation. Through its Regional Private Sector Economic Recovery and Resilience Stimulus Plan, Equity Group intends to support small and medium-sized enterprises (SMEs) in East and Central Africa’s agriculture, manufacturing and logistics, trade and investment, social and environmental sectors over the next five years. The package is substantial: USD 6 billion, which was equivalent to almost 70% of Equity’s total balance sheet in 2020. The group led by Kenya’s James Mwangi had a total balance sheet of about USD 9 billion, according to the latest figures published on 31 December 2020. “This recovery and resilience plan is a kind of Marshall Plan, in which we commit USD 6 billion to support the continent’s industrialisation by helping SMEs and creating 50 million direct and indirect jobs in our countries of operation over five years,” Mwangi told The Africa Report. The bank holding company has subsidiaries in Kenya, Uganda, South Sudan, Tanzania, Rwanda and the Democratic Republic of the Congo – as well as a representative office in Addis Ababa, Ethiopia.-Source: The Africa Report

East Africa

East African Countries in USD 8 Billion Investment Plan

East African states will jointly benefit from at least USD 8.77 billion worth of investments in transport, healthcare, energy, and agriculture among other sectors, from deals made at the 2021 African Investment Forum concluded on Thursday.

The three-day event was organised by the African Development Bank (AfDB) in partnership with other finance organisations, including Africa Export-Import (Afrexim) Bank and African Finance Corporation among others, these organisations yielded a total of USD 36.2 billion from 43 investment deals for the entire continent, 37.5 percent short of the expected USD 58 billion. – Source: The East African

East Africa – Central Africa

Investment in Young Firms Leads EA Deals

Early-stage venture capital (VC) investments recorded the biggest growth in new deals into East Africa last year, targeting the financial, agribusiness and ICT sectors which have recently offered high growth potential. An analysis of deals carried out by investment adviser I&M Burbidge Capital shows that VC deals jumped from 16 in 2020 to 29 last year.

This contrasted with the slowdown in deals involving later stage private equity, which fell by three to 38, development finance institution (DFI), down from 16 to nine, and mergers & acquisitions which dropped from 26 in 2020 to 17 last year.

“The region has witnessed a shift towards early-stage investments, with 29 VC transactions being recorded, with a total disclosed deal value of USD 56.28 million (up from USD 39.07 million in 2020) and median deal value of USD 2.30 million (USD 2.28 million in 2020),” said I&M Burbidge Capital in its 2021 annual financial review. – Source: Business Daily

Côte d’Ivoire

Côte d’Ivoire Tests New Cocoa Traceability System to Fight Deforestation

Côte d’Ivoire will launch a pilot project in April to trace cocoa beans from farm to market, aiming to tackle issues such as deforestation and child labour, the head of the West African nation’s cocoa regulator has said. The new system will allow manufacturers and consumers to know the exact origin and production conditions of cocoa beans, the main ingredient in chocolate. It will also introduce a new payment system aimed at ensuring farmers get a fair wage. The move comes in response to plans by the European Union to ban imports of commodities and products linked to deforestation and human rights abuses. “The objectives of our traceability system is to control the origins and the entire circuit of beans, fight against deforestation and pay the guaranteed price to farmers,” said Yves Brahima Kone, head of the Cocoa and Coffee Council (CCC). Currently, exporters have their own traceability systems that are not compatible with one another and do not make it possible to accurately determine the route of Ivorian beans from production to market. – Source: Reuters

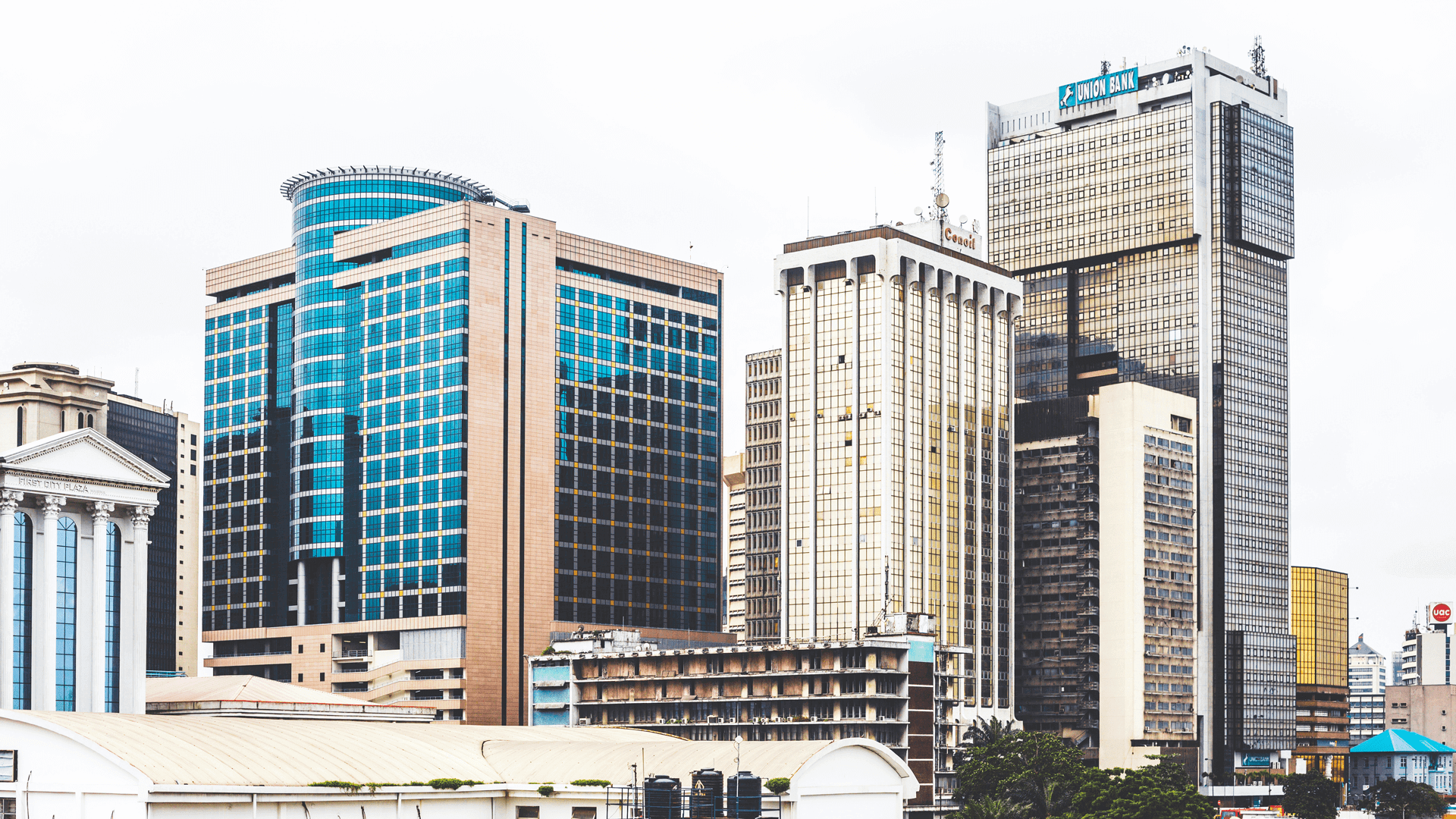

Nigeria

AfDB Secures USD 15.6 Billion for Lagos-Abidjan Highway Corridor

The president of the African Development Bank (AfDB), Dr Akinwumi Adesina, announced that the bank has secured USD 15.6 billion for the construction of the Lagos-Abidjan highway corridor, which would ease transportation across West Africa. He made this announcement during the 2021 Africa Investment Forum virtual boardroom closing session on Thursday, 17 March. The AfDB president said, “the biggest deal for the boardroom is the USD 15.6 billion deal for the Lagos-Abidjan highway corridor. The 46-lane highway corridor will connect Lagos, Cotonou, Lome, Accra and Abidjan.” According to him, this project would support trade in West Africa, impacting the lives of over 500 million people, reducing transport costs and increasing intra-regional trade volume. “It will support 75% of the trade in the West African region. It would reduce transport cost by 48%. It would increase intra-regional trade volume by 15% to 25%. It would connect land-locked cities to port countries,” he added. – Source: The Punch

The budget aims to support Morocco’s key sectors, including water, agriculture, social inclusion, human development, and infrastructure, Vice President of AfDB in charge of Agriculture and Human and Social Development Beth Dunford said at the end of a working visit in Morocco on Tuesday. During her visit to Morocco, Funford held several meetings with senior Moroccan officials, a statement from AfDB said on Tuesday. The meetings served as an opportunity to discuss different aspects of the partnership, the statement added.

“With Morocco, we have been linked by a historic partnership for more than half a century,” Dunford said. She added that the bank has mobilized USD 12 billion for more than 170 operations in Morocco as part of the partnership between the two parties.- Source: Morocco World News

Mozambique

Mozambique Joins Collaborative ICT Data Collection Initiative Developed by AfDB

The African Development Bank (AfDB) has extended membership of a digital data supervision system known as the Remote Appraisal Supervision, Monitoring, and Evaluation (RASME) project to Mozambique, making it the sixth African country to benefit from the tool which enhances project-related data collection in remote areas. RASME is a partnership of the AfDB and the World Bank’s Geo-Enabling initiative for Monitoring and Supervision and KoBoToolbox teams. The digital data gathering suite of tools being used for the RASME project is based on the KoBoToolbox platform, an open-source information and communications technology (ICT) solution developed by researchers affiliated with the Harvard Humanitarian Initiative. The initiative uses mobile devices and personal computers to enable bank staff to remotely collect digital project data directly from the field in real-time. The onset of the COVID-19 crisis has sharpened the need for remote data collection tools. Mozambique’s Deputy Minister of Economy and Finance, Carla Alexandra Louveira, and the AfDB’s country manager, Cesar Mba Abogo officially launched the initiative. – Source: AfDB

Kenya

Kenya to Host One of Africa’s Two Giant Data Hubs

Kenya will host one of the two mega data centres in Africa that will increase internet speed and make it harder for hackers to bring down websites. The new data centres, which will have multiple servers with a high bandwidth to deal with spikes in traffic, will offer the continent faster access and better protection from cyberattacks. The Internet Corporation for Assigned Names and Numbers (ICANN), the non-profit corporation that coordinates the domain name systems, announced that it will set up two Root Server (IMRS) clusters, one of which will be in Kenya. “The clusters ensure that internet queries from Africa can be answered within the region, and not be dependent on networks and servers in other parts of the world, thus reducing latency and improving internet user experience in the entire region,” the organisation entrusted with stewarding the internet’s unique identifier systems in the world said. Information and Communications Technology Cabinet Secretary Joseph Mucheru said the new infrastructure is in line with the African Digital Transformation Strategy (2020-2030) and more specifically, with Kenya’s Digital Economy Blueprint, which identifies infrastructure as one of the five key pillars necessary for the digital transformation of the economy. – Source: Business Daily

Africa Lens on Ukraine Crisis

Could Africa Become Europe’s Next Gas Station’?

Experts expect Europe to ramp up investments in Africa’s natural gas sector to shock-absorb its economy from the unfolding crisis in Ukraine and the potential for energy supplies disruption in the future.

In January, the European Union drafted a proposal to classify natural gas projects as “green energy” investments, potentially allowing the bloc to invest in the sector and at the same time contribute to what African nations are increasingly calling a “just transition” in the energy sector as the continent taps into gas and uses the proceeds to build on its huge green energy opportunities. According to the Brookings Institution, the result of the January decision is that Europe is likely to be a key financier. However, there may be a number of international players eyeing Africa’s gas and renewables opportunities. And Russia’s invasion of Ukraine is focusing attention with startling speed. With BP divesting its stake in Russian state-oil company Rosneft, it may also look for new business opportunities in Africa. – Source: Daily Nation

The Russia-Ukraine War Threatens Africa’s Wheat Supply

Russia’s invasion of Ukraine is likely to disrupt Africa’s wheat supply and heighten food insecurity in some parts of the continent including Somalia, which is experiencing its worst drought in decades.

“A decline in wheat trade will have a compound effect on the drought, as so much of our food comes from Russia and Ukraine. From the price of goods, to the actual supply, Somalia is going to feel the impact of this crisis for many months to come,” says Abdullahi Nur Osman, CEO of the Hormuud Salaam Foundation, a philanthropic organisation that delivers aid to drought-impacted communities in Somalia.

Somalia imports most of its wheat from Egypt, which imports about 85% of its wheat from Russia and Ukraine. – Source: Quartz Africa

Russia’s Invasion of Ukraine May Drive a Wedge Between the West and Africa

The apparent reluctance of many African countries to condemn Russia’s invasion of Ukraine has caught many Western governments, diplomatic experts, and observers of Africa’s international relations by surprise. Although twenty-eight African countries voted in favor of the March 2, 2022, UN General Assembly (UNGA) resolution demanding that Russia “immediately, completely and unconditionally withdraw all of its military forces from the territory of Ukraine within its internationally recognised borders,” notably, seventeen African nations abstained while no votes were recorded from another eight.

Unsurprisingly, Eritrea, whose leader Isaias Afwerki enjoys a close relationship with Russian President Vladimir Putin, and who has long staked out an anti-Western diplomatic stance, joined Belarus, North Korea, Russia, and Syria in voting against the resolution. In total, 141 (out of 194) UN member states endorsed the resolution.

Except for the speech by Kenya’s Permanent Representative to the United Nations Martin Kimani vigorously affirming the sanctity of international borders and rejecting “irredentism and expansionism on any basis,” African diplomats have largely maintained a studied silence, and, significantly, none of the twenty-eight supporters of the resolution, including regional powerhouse Nigeria, has come out to elaborate on its position. – Source: Council on Foreign Relations

Putin’s War on Ukraine: Aftershocks in the Europe-Africa Partnership

Russian President Vladimir Putin’s full-scale invasion of Ukraine has inspired unprecedented shifts in European economic, foreign, and energy policy. It has led to greater solidarity within the European Union, NATO, and the transatlantic alliance. But it risks diverting Europe’s attention away from Africa.

Just a week before the invasion, European and African leaders met to map out their common future. Now the world has changed, raising the stakes of that partnership. Whatever happens next in Ukraine will have significant implications for African countries. – Source: European Council on Foreign Relations

Ukraine Crisis Impact on Global Businesses

As the senseless invasion of Ukraine continues, a horrified world watches the humanitarian crisis deepen by the day. Already more than 2,000 civilians have been killed or injured and more than 3 million refugees have fled the country, where damage to infrastructure and buildings exceeds USD 100.

Business leaders have rightly focused first on this human tragedy, taking immediate actions to ensure the safety and well-being of their people and leaning in to help however they can. Airbnb has offered free temporary housing for 100,000 refugees; companies such as GSK and Roche have donated antibiotics and painkillers; many others are donating millions of dollars in aid. Hundreds of companies, including Bain and Company, have suspended operations in Russia or exited the country entirely.

The war also has created a high level of uncertainty in the global business environment, despite the fact that Russia, Belarus, and Ukraine are not major global end markets. With a gross domestic product of USD 1.8 trillion, Russia’s economy is roughly one-tenth the size of China’s. Ukraine and Belarus are even smaller, with USD 0.2 trillion and USD 0.1 trillion in GDP, respectively.

Click here to download the report.

Ten Ways the War in Ukraine will Change the World

Russia’s invasion of Ukraine marks a defining moment in the reshaping of the geopolitical order. The battle for Ukraine is not just another regional war: : it represents a rupture in Russia-West relations that will have profound repercussions for Europe and the world. This analysis outlines how the conflict will influence the global balance of power and lead to a further unravelling of the post-Cold War order.

Click here to download the report.

Reports

Global Economic Prospects 2022

The Global Economic Prospects delves into the Global economic outlook that focuses on pandemic developments, global trade, commodity markets and global inflation and financial developments. This report covers various regions across the globe such as Sub Saharan Africa, Middle East and North Africa, Europe and Central Asia, South Asia, Latin America and the Caribbean and East Asia and the Pacific.

Click here to download the report.

AfCFTA Country Business Index (ACBI) Report 2022

The AfCFTA Country Business Index Report gives insight into restrictiveness of goods and their costs. However, the report largely elucidates on the use and awareness of FTAs especially for businesses in various regional blocs. This index is seen as one of the primary tools through which businesses can voice their views on the implementation of the AfCFTA by identifying main trade constraints.

Click here to download the report.